Inflation has put pressure on households across the U.S., and while federal stimulus checks are no longer being distributed, several states are stepping in with their own financial relief measures. Inflation stimulus payments in 2025 are designed to support low- and middle-income families, offset rising costs, and stimulate local economies.

From tax refunds to utility bill credits, states are tailoring programs to meet residents’ needs. Here’s a breakdown of where money is being sent, how much you could receive, and who qualifies.

Why States Are Issuing Inflation Stimulus Payments in 2025

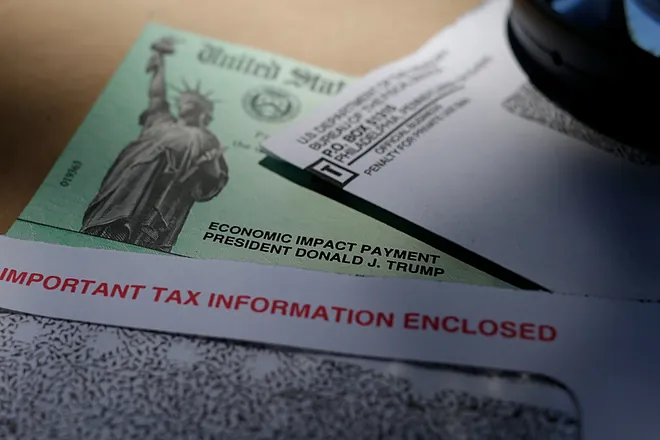

During the COVID-19 pandemic, federal stimulus checks provided critical aid, with more than $814 billion distributed nationwide. But once the public health emergency ended, those checks stopped.

The federal government under President Donald Trump has not signaled any plans to restart direct payments. That vacuum has prompted individual states to step in with their own relief efforts, ranging from direct stimulus checks to tax refunds and energy credits.

The goal is twofold:

- Support vulnerable populations struggling with higher living costs.

- Boost economic activity by putting money back into circulation.

California Climate Credit – Utility Bill Relief

California residents can expect relief in the form of a 2025 California Climate Credit. Instead of direct cash payments, the state issues credits on utility bills:

- Payments range from $35 to $259, depending on household and utility provider.

- Credits are automatically applied, so no separate application is required.

This program helps households absorb rising energy costs while encouraging sustainable energy use.

New York Inflation Stimulus Check 2025

New York launched a new inflation stimulus program in 2025 worth $8 million in total relief. Payments come in the form of tax refunds:

- Single filers earning up to $75,000: up to $200.

- Joint filers earning up to $150,000: up to $400.

Eligibility is determined by 2023 tax returns, meaning residents don’t need to reapply—payments are issued automatically if you qualify.

New Mexico Inflation Rebates 2025

New Mexico has been among the most proactive states in providing direct relief. In June 2025, eligible residents received:

- $500 for single taxpayers

- $1,000 for joint filers

The payments were sent out automatically to taxpayers who filed state income tax returns, offering broad relief amid ongoing inflation.

Pennsylvania Inflation Rebates

Pennsylvania is continuing its homeowner and renter rebate program, which expanded in 2025 to account for inflation. Payments ranged from $500 to $1,000, depending on income and housing status.

- Eligible households: incomes up to $46,520.

- Refund amounts are tied to prior-year tax filings.

This program particularly supports seniors, disabled residents, and renters struggling with housing costs.

Other States Sending Inflation Relief

While not every state is issuing direct stimulus checks, several others have programs aimed at helping low-income households and boosting consumer spending:

- Colorado – Tax rebates for residents meeting income thresholds.

- North Dakota & South Dakota – Expanded welfare programs for struggling families.

- Georgia – One-time rebates linked to 2023 tax filings.

- Michigan – State-funded support for low-income households.

- Minnesota – Rebate programs targeting families with dependents.

Each state tailors its relief program differently, but the unifying theme is targeted support for those hit hardest by inflation.

Are You Eligible for 2025 Inflation Stimulus Payments?

Eligibility varies widely depending on your state:

| State | Type of Relief | Eligibility Highlights | Payment Range |

|---|---|---|---|

| California | Utility bill credit (Climate Credit) | Automatic for utility customers | $35 – $259 |

| New York | Tax refund | Income up to $75k (single) / $150k (joint) | $200 – $400 |

| New Mexico | Direct rebate | Tax return filed in 2023 | $500 – $1,000 |

| Pennsylvania | Homeowner/renter rebate | Income up to $46,520 | $500 – $1,000 |

| Georgia, Michigan, Minnesota, Dakotas, Colorado | Welfare or tax-based relief | Varies by state program | Varies |

Key Takeaways

- Federal stimulus checks have ended, but state-level programs are filling the gap.

- Payments in 2025 include tax refunds, rebates, and energy credits.

- Eligibility is usually based on 2023 tax returns or income limits.

- Relief amounts vary, from a few hundred dollars to over a thousand, depending on state and household status.

For residents in eligible states, these inflation stimulus payments in 2025 offer a timely buffer against rising prices and household costs.