If you’re building a serious watch collection, spotting tomorrow’s legends today is where the real value lies. While household names like the Rolex Submariner, Daytona, and Audemars Piguet Royal Oak are already secure icons, not every piece in circulation is destined to appreciate.

So, what are the best classic watches to invest in 2025? To answer that, we turned to Quaid Walker, founder of Bezel, who shared which models have the strongest chance of becoming future grails. These are the watches seasoned collectors are quietly hunting now.

Why Watch Investment Matters in 2025

- Growing demand: Auction houses are setting record prices for vintage and independent brands.

- Scarcity factor: Discontinued models and limited releases are appreciating fastest.

- Independent rise: FP Journe, MB&F, and H. Moser are joining Rolex and Patek in serious collector conversations.

- Design pedigree: Watches with unique aesthetics (Cartier, Nomos) are proving just as valuable as complicated mechanisms.

The market is shifting — and if you want to play it like a connoisseur, it pays to look beyond the usual suspects.

Rolex Still Leads: Classic Grails With Long-Term Value

Rolex Submariner “Hulk” ref. 116610LV

- Production years: 2010–2020

- Unique feature: Only Submariner with a green dial + green ceramic bezel

- Investment case: Discontinued, iconic colorway, growing collector demand

- Market value: Upper 5-figures and climbing

Walker notes: “The Hulk doesn’t take itself too seriously. Spot one in the wild, and you’re likely dealing with a serious collector who has plenty more in the safe.”

Rolex Daytona Platinum ref. 126506-0002

- Launch year: 2013

- Breakthrough: First-ever Rolex with a transparent caseback

- Why it matters: Either the start of a new design era — or a rare one-off experiment

- Collector profile: Appeals to Rolex purists and avant-garde fans alike

Whether Rolex continues with transparent casebacks or not, this Daytona holds a place in history.

Independent Watchmakers on the Rise

FP Journe Chronomètre Bleu

- Case material: Tantalum (a metal rarely used in watchmaking)

- Dial: Striking deep-blue tone, highly recognizable

- Collector’s edge: Journe’s limited production and soaring auction values

- Investment view: A six-figure buy-in today with strong upside potential

Journe has already joined the ranks of Patek Philippe and Rolex at global auctions. For investors with serious capital, this is one of the best classic watches to invest in 2025.

MB&F Legacy Machine Perpetual Evo Ice Blue

- Design: Domed sapphire crystal with exposed movement

- Complication: User-friendly perpetual calendar (famously complex in most watches)

- Why invest: MB&F has a cult following that’s rapidly expanding

- Future value: Positioned to shift from niche to mainstream collectible

Walker calls MB&F’s perpetuals “the best expression of the brand’s playful engineering.” Expect demand to follow as awareness grows.

H. Moser & Cie Streamliner Small Seconds 39

- Aesthetic: 1970s-inspired integrated bracelet, but more minimalist than Royal Oak or Nautilus

- Brand DNA: Known for witty designs (like the Swiss Alp Watch parodying Apple Watch)

- Why invest: Streamliner line is fast becoming Moser’s signature

- Market growth: Mid-high 5 figures now, likely to gain prestige

Accessible Entry Points for Collectors

Not every watch investment requires six figures. Some of the best classic watches to invest in 2025 come from brands offering strong design, heritage, and collectibility at lower price points.

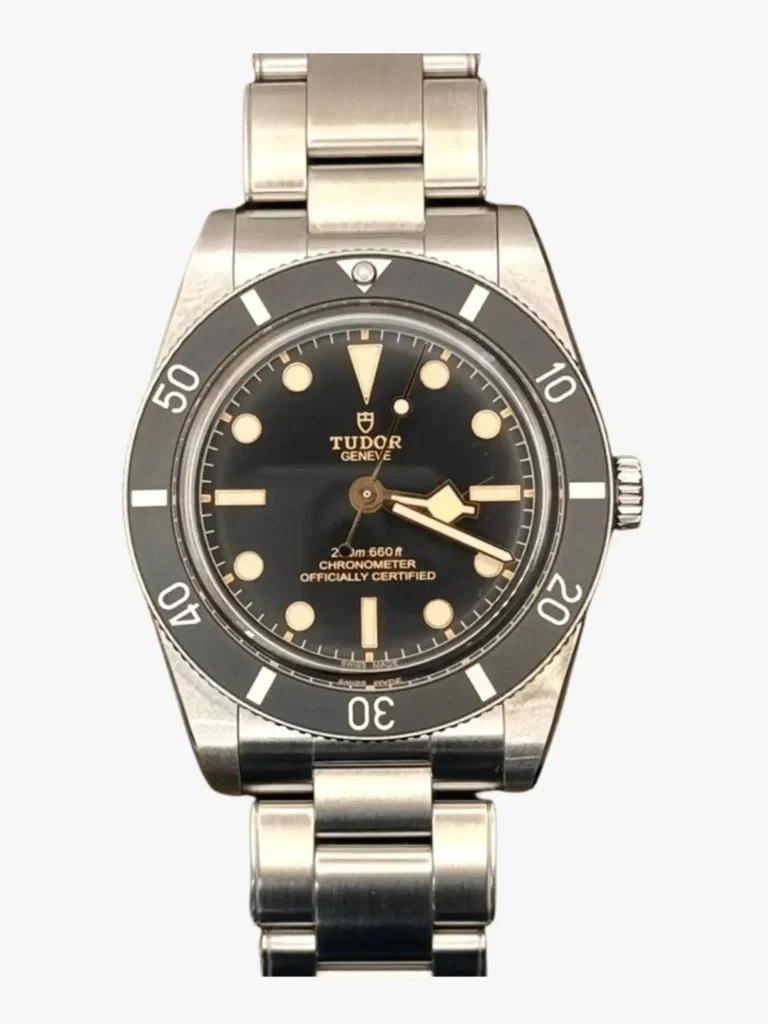

Tudor Black Bay 54

- Case size: 37mm — faithful to early Rolex divers

- Price range: Low to mid 4 figures

- Collector appeal: Combines heritage vibes with modern build quality

- Investment angle: Safe entry into vintage-inspired luxury watches

Walker: “It’s one of the best vintage-inspired designs I’ve seen in my career.”

Nomos Glashütte Zürich Weltzeit

- Origin: Made in Germany, Bauhaus-inspired

- Complication: World time function

- Price range: Low 5 figures — far less than Swiss rivals

- Collector appeal: Clean design, in-house movements, rising reputation

Nomos is graduating from “starter brand” to one serious collectors also respect. The Weltzeit is its standout model.

Cartier: Where Design Drives Value

Cartier Tank Asymétrique “New York 5th Ave”

- Case shape: Slanted parallelogram — rare even within Cartier’s Tank family

- Special edition: Platinum case, dial homage to Fifth Avenue boutique

- Collector interest: Seen as the more attainable sibling of the Cartier Crash

- Price range: Mid to high 5 figures

With Cartier Crashes trading around $300,000, this Asymétrique offers a design-forward alternative with real rarity.

Comparison Table: Best Classic Watches to Invest in 2025

| Watch | Standout Feature | Why It’s Investable | Estimated Price (2025) | Collector Profile |

|---|---|---|---|---|

| Rolex Submariner Hulk | Green dial + bezel | Discontinued, iconic colorway | High 5-figures | Mainstream + serious collectors |

| Rolex Daytona Platinum | First transparent caseback | Historical importance | 6-figures+ | Rolex elite |

| FP Journe Chronomètre Bleu | Tantalum case | Indie prestige, auction darling | 6-figures | High-net-worth collectors |

| MB&F LM Perpetual Evo | Playful perpetual calendar | Cult brand, future mainstream | 6-figures | Avant-garde fans |

| H. Moser Streamliner 39 | Minimalist integrated bracelet | Brand-defining model | Mid-high 5 figures | Modernist collectors |

| Tudor Black Bay 54 | Vintage-inspired 37mm | Affordable entry point | Low-mid 4 figures | New investors |

| Nomos Zürich Weltzeit | Bauhaus world time | Rising brand recognition | Low 5 figures | Entry-to-mid collectors |

| Cartier Tank Asymétrique | Parallelogram Tank | Rare design, alternative to Crash | Mid-high 5 figures | Design-focused investors |

Tips for Buying Classic Watches in 2025

- Prioritize condition: Original parts and documentation matter more than hype.

- Trusted sources: Stick to established marketplaces (Bezel, Chrono24), auction houses (Phillips, Sotheby’s), and vetted dealers.

- Understand rarity: Limited runs, discontinued models, and unique case materials tend to appreciate most.

- Balance portfolio: Mix safe bets like Rolex with high-upside independents.

- Think long term: Watch investment rewards patience; quick flips are risky.

The best classic watches to invest in 2025 share three traits:

- Scarcity (limited production, discontinued, or rare features).

- Strong design identity (instantly recognizable aesthetics).

- Growing collector demand (independents and design houses rising fast).

Rolex remains the anchor, but the smartest money in 2025 may be on independents like FP Journe, MB&F, and H. Moser — plus the design pedigree of Cartier and Nomos. Whether you’re hunting six-figure grails or more accessible classics, these are the models worth your attention this year.

great submit, very informative. I’m wondering why the opposite specialists of this sector don’t notice this. You should continue your writing. I’m confident, you have a great readers’ base already!